In recent months, the rising price of meat in markets has become a focal point of public attention. In this regard, the Ministry of Agriculture of Uzbekistan has issued an official statement. The document elaborates on the factors affecting the cost price of meat, the situation in domestic and foreign markets, and the current state of prices.

What are the prices in the markets?

According to the ministry's data, currently:

- in subsidized market stalls, beef and lamb meat are sold for 65,000–75,000 soums,

- in regular trade stalls — 90,000–95,000 soums,

- and in trade centers, they are sold for 95,000–100,000 soums.

In Tashkent, a detailed analysis in this sector has also been provided:

- Meat priced at 65,000–75,000 soums accounts for 15–18 percent of buyers,

- meat priced at 90,000–95,000 soums — 82–85 percent,

- and meat priced at 110,000–130,000 soums (boneless) — only 1–2 percent.

Global trends: not only in Uzbekistan

The ministry emphasizes that the rise in meat prices is not just a local issue but a global process observed worldwide.

- In Russia, the price of chicken meat has increased by 9.7%,

- and in Kazakhstan, it has risen by 4.7%.

At the same time, it was noted that prices in Uzbekistan are stable compared to global market fluctuations.

Supply and maturity level

In the first quarter of 2025, the main factors affecting meat prices were mentioned as follows:

- the rising cost of feed raw materials,

- increased costs of electricity and fuel,

- and the level of providing livestock with sufficient feed — only 35–40%.

The increase in feed prices is not theoretical but reflected in specific figures:

Production and import: what do the numbers show?

In 2024:

- 2.9 million tons in live weight,

- 1.7 million tons in slaughter weight of meat were produced.

- Import — 93,000 tons (5.4% of the total volume).

70% of the imported meat was delivered to processing enterprises, while the rest was supplied to the population through subsidized stalls in farmers' markets.

The average import price is $4. The main suppliers are Belarus and Kazakhstan.

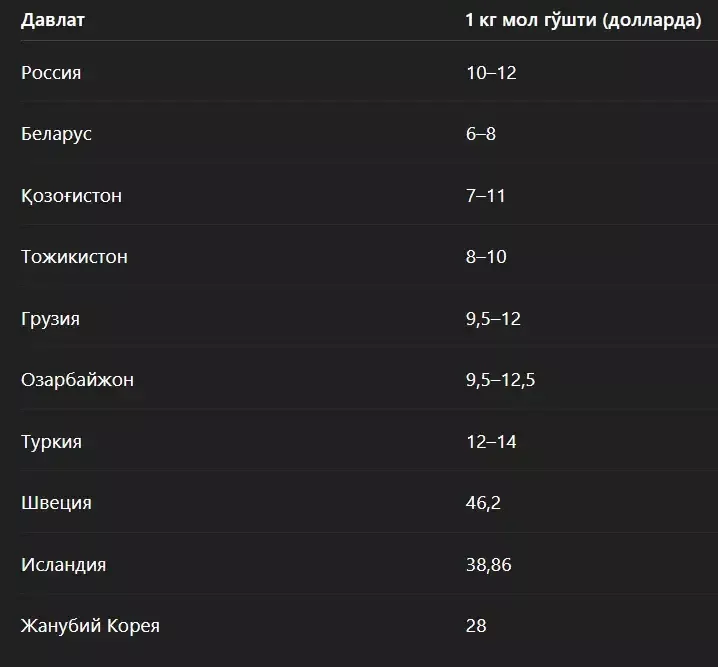

International comparison: where and how much is meat?

According to the ministry's data, Uzbekistan is one of the countries where meat is sold at the lowest prices, ranking second in Central Asia after Kyrgyzstan.

The editorial board of Zamin.uz considers this analysis a step that allows for a healthy and impartial assessment of the price concept related to daily needs. The important solution for consumers is not to criticize the price but to understand the underlying factors and make informed decisions.