Grentem: There is a bubble risk in the artificial intelligence market

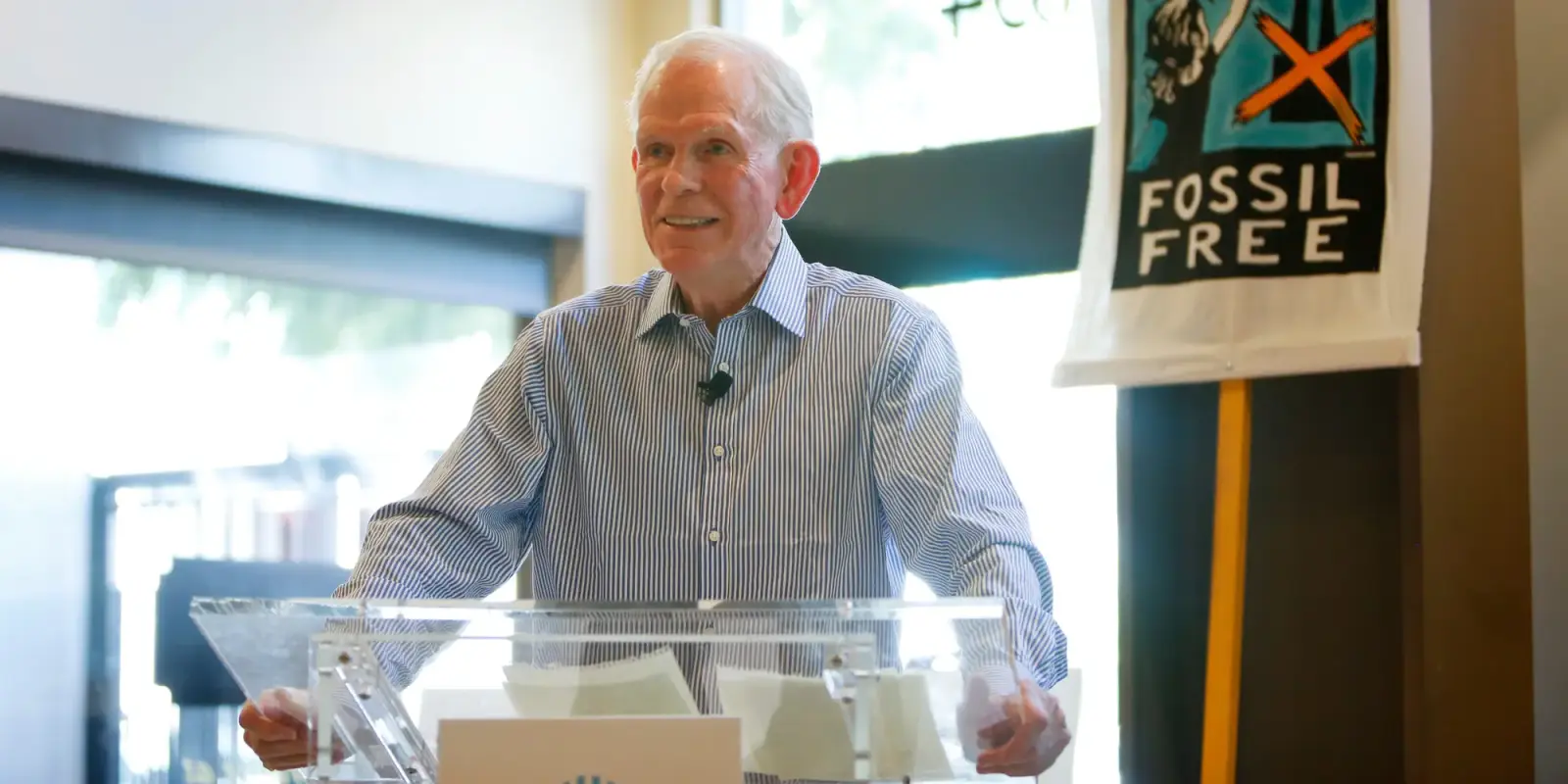

Jeremy Grentem, co-founder of GMO investment company and known for early detection of market "bubbles," compared the current hype around artificial intelligence (AI) to classic signs of a market bubble. This was reported by Zamin.uz.

He expressed these views on Bloomberg's Merryn Talks Money podcast, suggesting that this situation may ultimately end with a painful market correction. Grentem emphasized that artificial intelligence has the potential to fundamentally transform the economy and business.

However, financial markets are repeating an old scenario: investors are expecting higher returns than the technology's real economic impact justifies, and asset prices are excessively inflated. He recalled similar situations during the 19th-century railroad expansion and the late 1990s internet revolution.

Grentem recommended buying undervalued assets as the most reliable approach for long-term investment. According to him, strategies popular in the market, such as the small-cap effect, are actually based on one principle: buying undervalued assets and selling overvalued ones.

He also noted that the US stock market is currently overvalued. Such growth is linked to large-scale investments directed at artificial intelligence and high investor activity.

However, he stressed that the higher the prices, the lower the potential future returns might be. At the same time, Grentem did not call for a complete exit from the US market.

He stated that he sees the most promising opportunities in the venture capital and startup segments. In his opinion, the true potential of artificial intelligence in these areas has not yet been fully assessed.

Grentem elaborated on his views in his book titled “The Making of a Permabear: The Perils of Long-Term Investing in a Short-Term World,” which is dedicated to short-term market approaches and long-term investment risks.