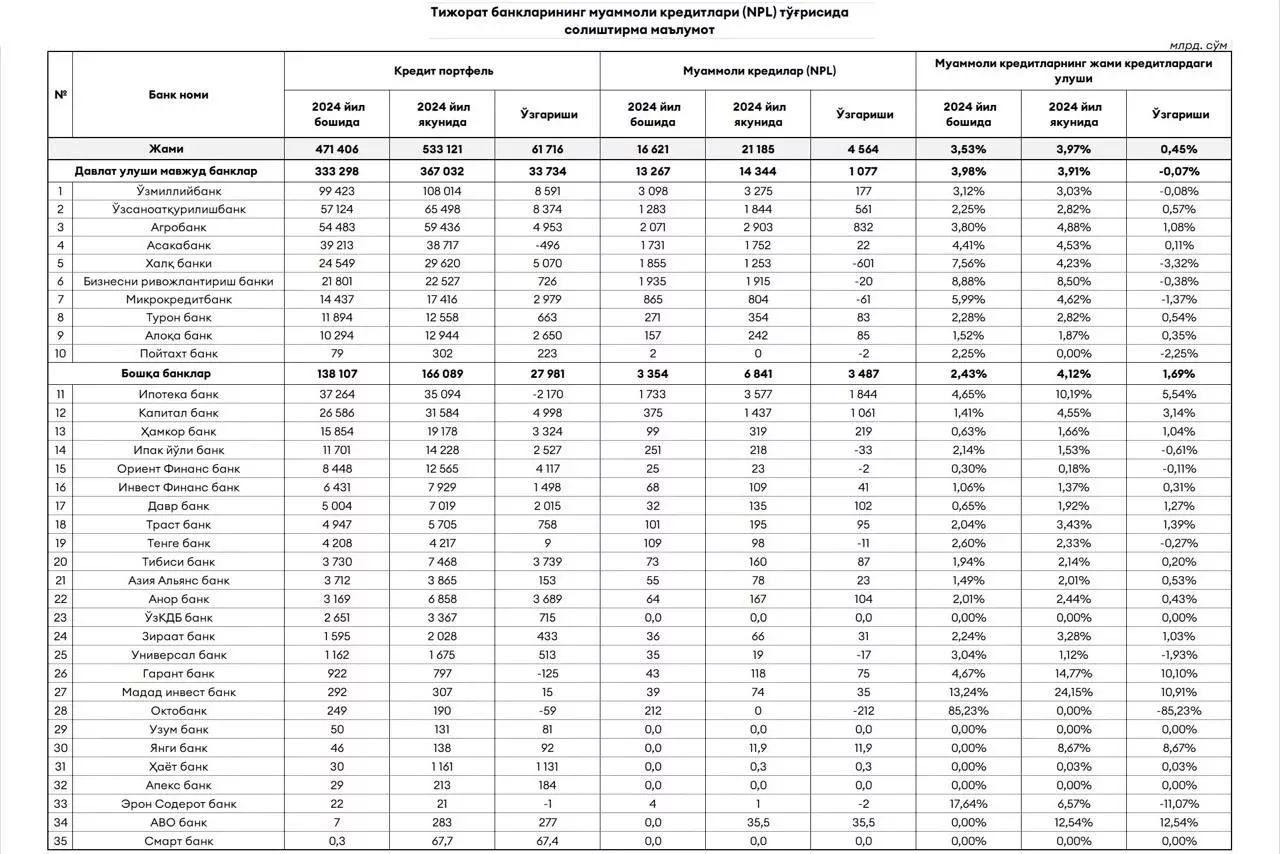

The amount of problematic loans in Uzbekistan reached 21.1 trillion soums

The Central Bank reported that as of January 1, 2025, the volume of problematic loans (NPL) in the country's commercial banks amounted to 21 trillion 185 billion soums.

In Uzbekistan, the credit portfolio of commercial banks amounted to 533.1 trillion soums in 2024.

What is the situation in state banks?

The volume of problematic loans in state banks amounts to 14 trillion 344 billion soums. “People's Bank” reduced its problematic loans by 601 billion soums compared to the beginning of the year, decreasing its share in the portfolio from 7.6 percent to 4.2 percent.

In “Microcredit Bank” and “Business Development Bank,” NPL has also slightly decreased.

In “Agrobank” (+832 billion soums), “Uzpromstroybank” (+561 billion soums), and “Uzmilliybank” (+177 billion soums), the amount of NPL has increased more rapidly compared to other state banks.

Situation in other banks

As of January 1, the volume of problematic loans in other banks amounts to 6 trillion 841 billion soums.

During 2024, a sharp increase in NPL was observed in “Mortgage Bank” (+1 trillion 844 billion soums) and “Kapitalbank” (+1 trillion 61 billion soums).

In “Hamkorbank” (+219 billion soums), “Anorbank” (+104 billion), “Davr Bank” (+102 billion soums), “Trastbank” (+95 billion soums), and “TBC Bank” (+87 billion soums), problematic loans have significantly increased.

Photo: Central Bank data

As of August 1, 2024, it was reported that the volume of problematic loans (NPL) in the country's commercial banks amounted to 20.82 trillion soums (1.64 billion dollars)