Agricultural products will be granted VAT exemption

Starting from January 1, 2026, Uzbekistan will implement a zero rate of value-added tax (VAT) on the sale of agricultural products (excluding cotton and grain products). This was reported by Zamin.uz.

This procedure applies to producers directly cultivating agricultural products and is established based on the President's decree UP-153 dated September 4, 2025. This was reported by podrobno.uz.

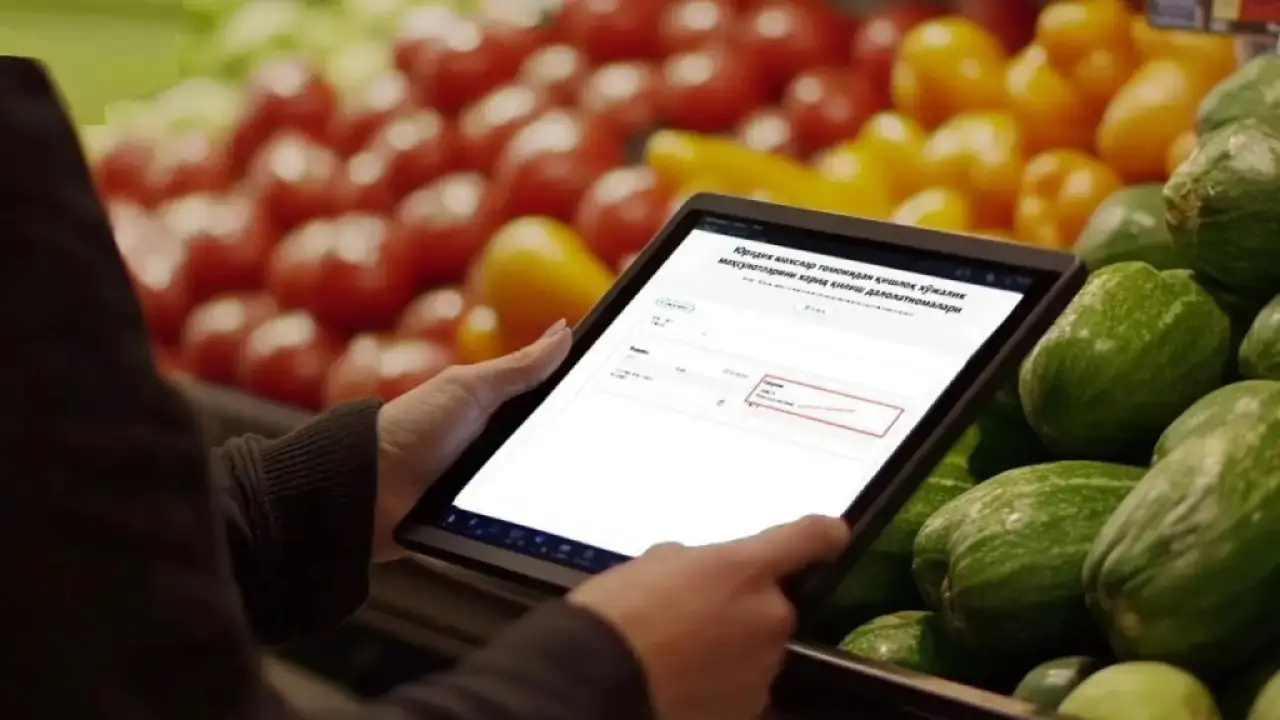

To use the zero rate, business entities must apply electronically to the tax authorities. The application is submitted through the taxpayer's personal account on the my3.soliq.uz portal.

For this, the "Electronic Document Circulation" section selects the service "Application for use of tax benefits for legal entities." The application form specifies the President's decree (UP-153) and the type of tax (VAT).

The validity period and text of the benefit are automatically generated by the system. Supporting documents such as cadastral information or a land lease agreement must be attached to the application.

Additionally, the names of the region, district, and neighborhood, as well as a contact phone number, are required. After all information is completed, the application is sent for review.

The review period is up to 15 days, and the process status can be tracked in the "List of Applications" section of the personal account. Once the application is approved, the zero-rate VAT is automatically applied in electronic invoices and taken into account when preparing VAT reports.

Furthermore, the Tax Committee announced changes in the taxation procedure for self-employed taxi drivers starting January 1, 2026. A reduced tax rate of 1% on turnover will be introduced for them.

Drivers and couriers will not be required to install a separate QR code for accepting payments.